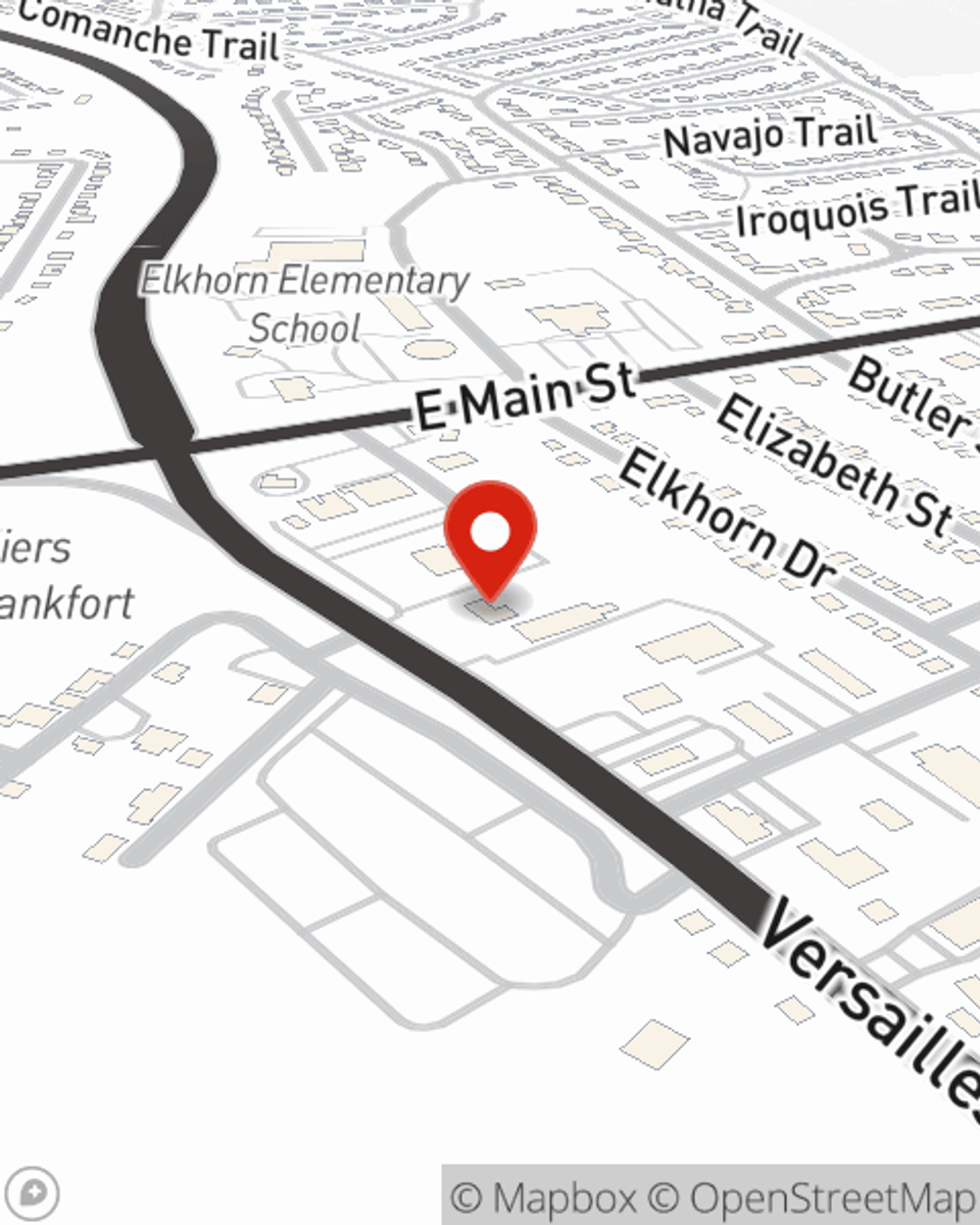

Business Insurance in and around Frankfort

Get your Frankfort business covered, right here!

No funny business here

- Georgetown

- Shelbyville

- Versailles

- Lexington

- Owenton

- Lawrenceburg

- Louisville

- Midway

- Simpsonville

- Sadieville

- Waddy

- Franklin County

- TWO CREEKS

State Farm Understands Small Businesses.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a pharmacy, a toy store, a hair salon, or other.

Get your Frankfort business covered, right here!

No funny business here

Keep Your Business Secure

Your business thrives off your tenacity commitment, and having great coverage with State Farm. While you put in the work and make decisions for the future of your business, let State Farm do their part in supporting you with business owners policies, worker’s compensation and artisan and service contractors policies.

Let's chat about business! Call Jason Dunn today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Jason Dunn

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.